Term Insurance

Term insurance is a type of Life insurance policy that provides coverage for a specific number of years i,e., a term. This type of Life insurance offers a death benefit to the beneficary or nominee in case of the insured death during the policy term.

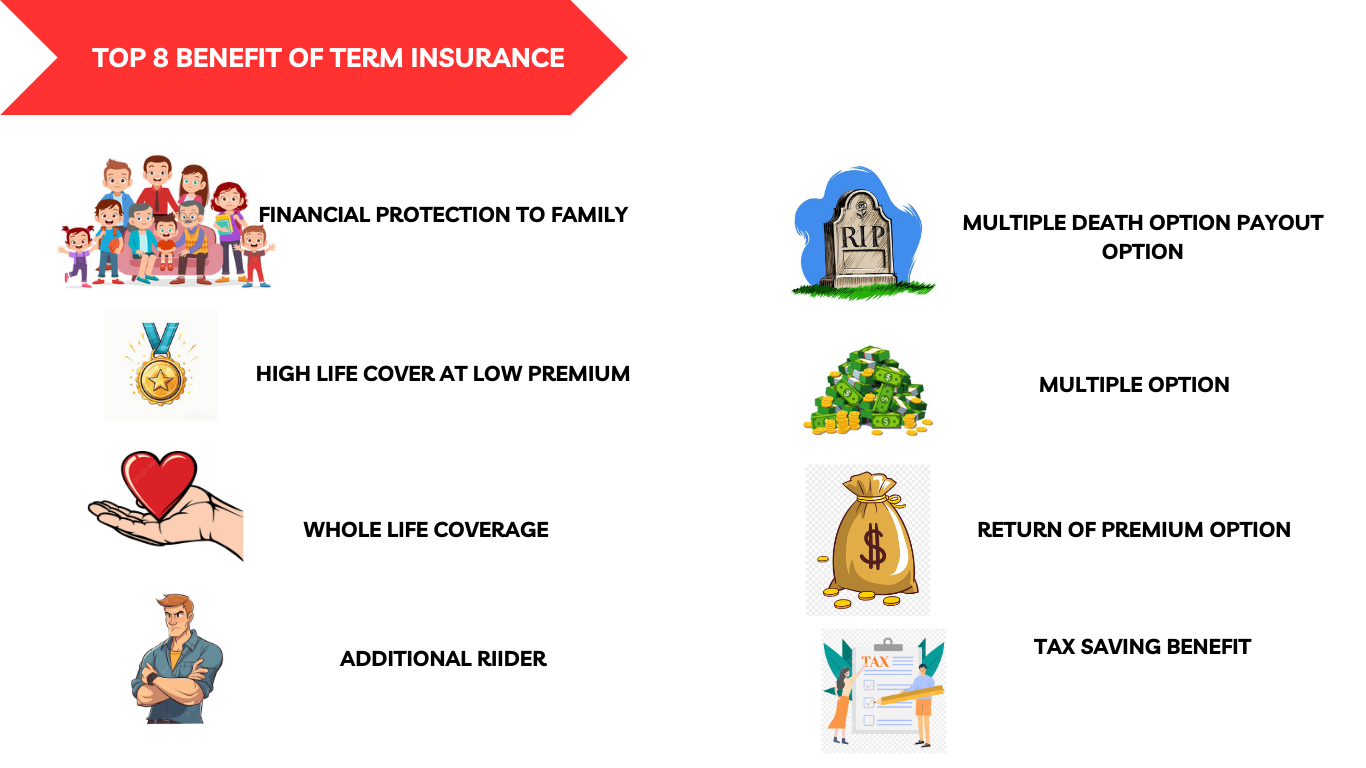

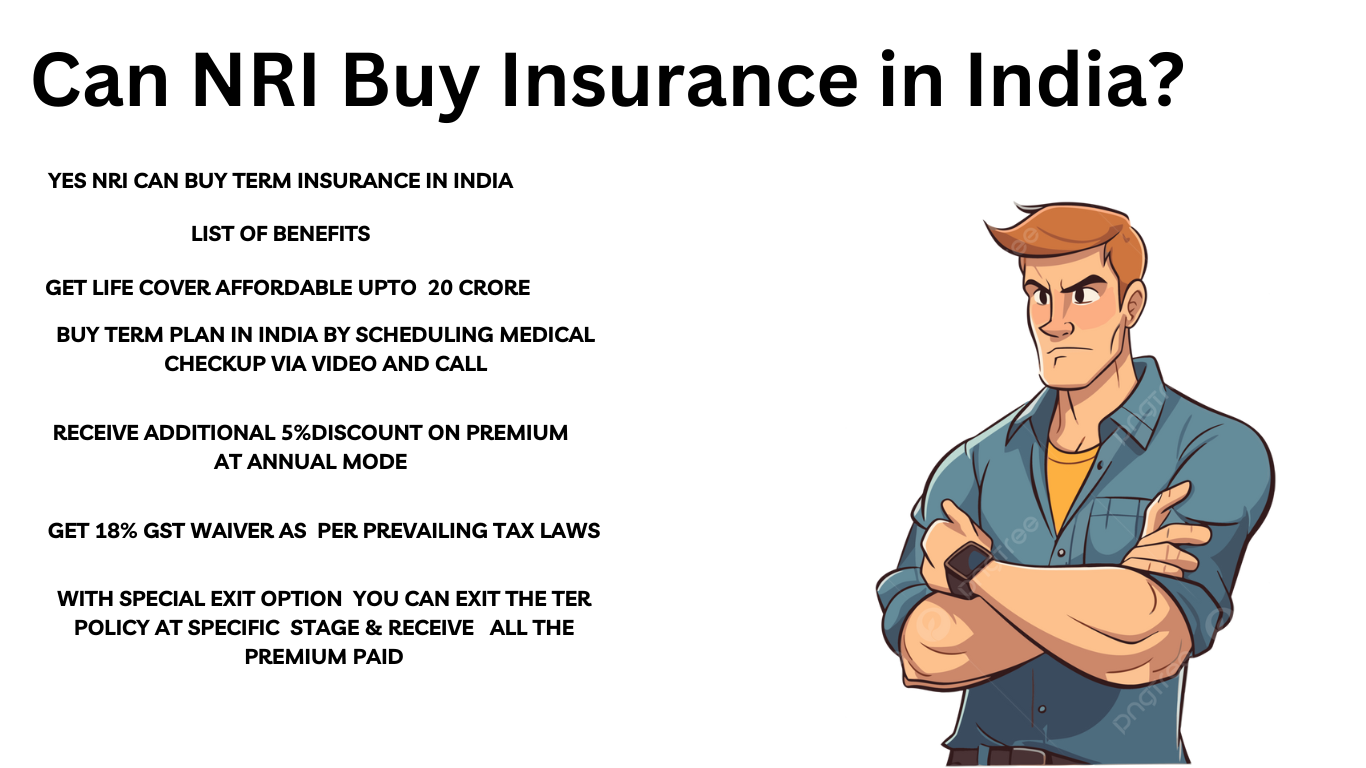

Term Insurance Benefits

What is Term Insurance?

Term Insurance is a type of Life Insurance plan that provides financial coverage to the policyholder family for a fixed time or years called the term of a policy. This type of Life Insurance offers a death benefit to the nomineee in case of death of the insured during the policy term. A term insurance plan provides high life cover at low premium plan.

Eg- A 30 years old healthy , non smoker male can buy a term policy cover Rs1 crore for his family for the next 20 years. if he buys a term plan he must pay only Rs 725/month. with this 1 crore cover, he can ensure that family will be able to maintain their current lifestyle without any hassels in case of his untimely death.

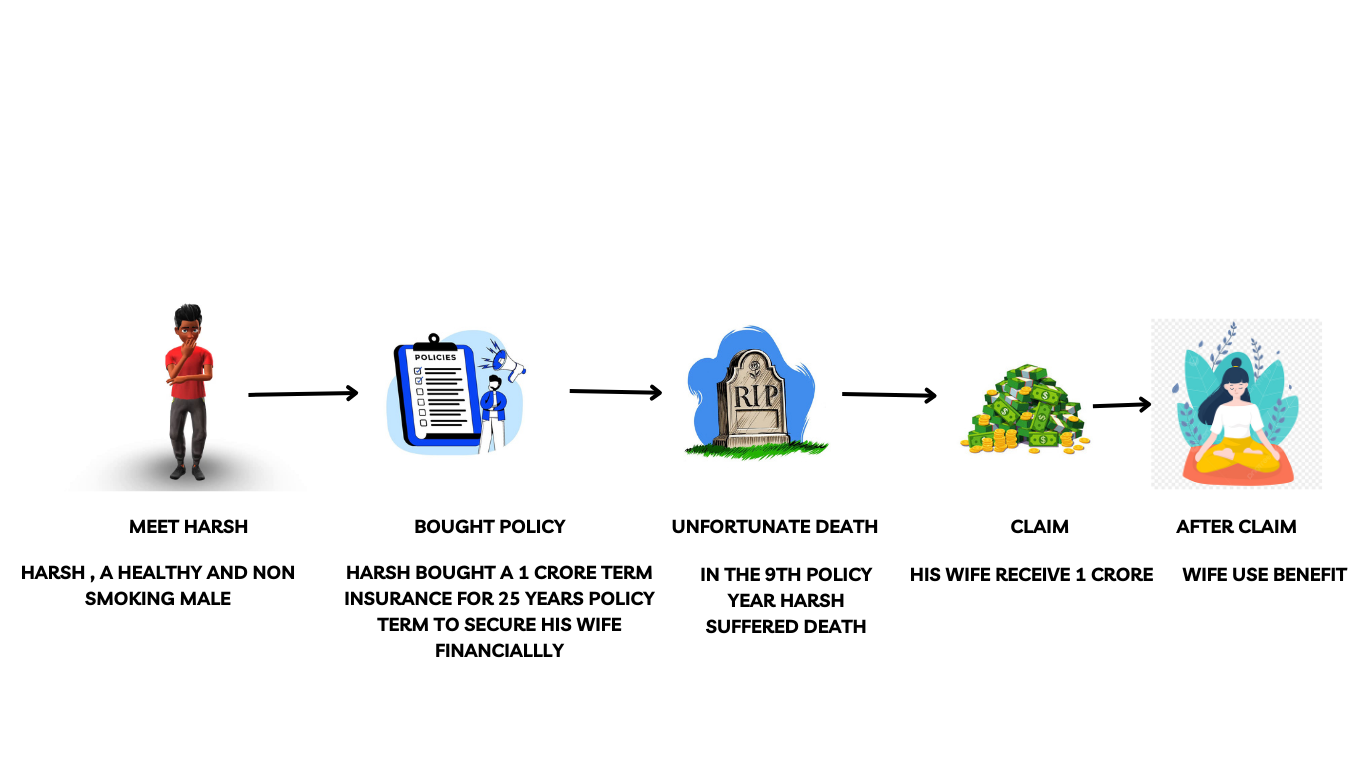

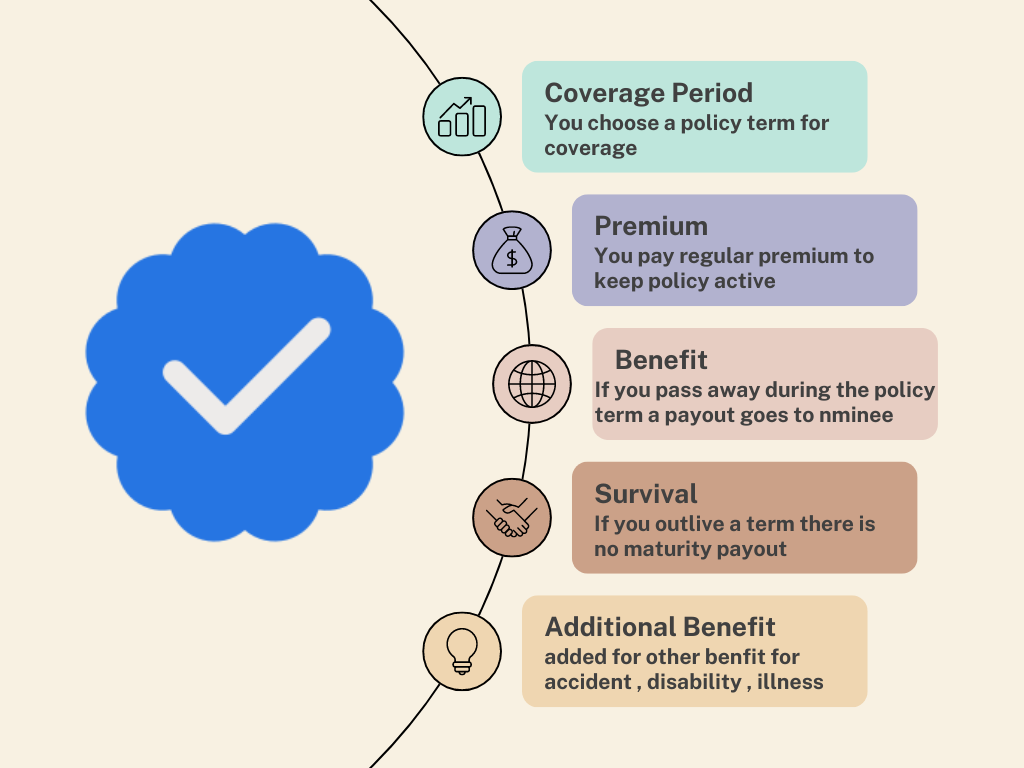

How Term Insurance Works?

COMMON QUESTION OUERIES

Term Life Insurance provides financial protection to your family and replaces your income in case you are not around. you pay a small fee every month/ year to protect your family, and in case something happens to you the insurance company pays a large sum of money (life cover) to your family.

- Life Cover - Amount that family receive on the demise of the policyholder( Should be 10 times your annual income).

- Cover Till age - The age till which the term plan protect your family(generally opted till 70).

- Payment Frequency - Premium can be paid monthly or annualy . annual premium have a 10% discount.

Life cover or sum assured is to take care of your family expense in your absence. expense includes household expense which will increase with time due to inflation and any existing loans.

The Thumb rule is to take a cover of 10 times your annual income. why? let me expalin with an example-

Annual income= 10L

Monthly Expense = 35000/month i.e 4.2L/year

Loan=20L

As per trend your expense double in 10 years due to inflation. net expense for the next 20 years would be 1.3 crore. adding 20L to pay off yoour loan your family would need approx 1.5 cr as per your Life cover.

Term insurance plans should cover you until your financial responsibilities are over.

- Do you want cover till you retire? ( since your financial obligation will be over). we recommend 65 in the case.

- Do you want to leave a legacy amount for your family? we recommend 75 in the case as life expectancy is 70 in India.

You can choose the number of years you wish to pay premium till the age 60 or the entire policy term i.e regular pay , or in 5/10/15 years, i.e limited pay. Choosing Limited pay has added benefit. you can save up to 54% on your overall premium if you select limited pay for the term plan.*58%of the customers select a payment term of 10 years.

Commonly used riders and reasons to add them.

Waiver of Premium on critical illness/disability- In case of permanent disability due to an accident or any critical illness, no future premium have to be paid. and the life cover stay intact. this is available as a free add on in most of the plans and is otherwise available at a minimum amount. highly recommend to add this to you term insurance plan.

Accidental Death Benefit- In case the death happens due to accident an additional payout (amount to be valued of the base sum assured) will be given over and above the base sum assured at a very nominal price. this is highly recommend to a person who travel a lot or ride a two wheeler frequently.

Critical illness rider - On dignosis of critical illness you will get a lumpsum amount immediately.

WHY SHOULD YOU BUY TERM INSURANCE PLAN

Protect your Asset

If you have asset like homes or vehicles through loans, your family might be financially burden trying to pay them off when you are no longer around.

Long Term Coverage

Long term coverage is given to insured by insurer.

Who Should BUY Term Plan

How Does Term Insurance Plan Work?

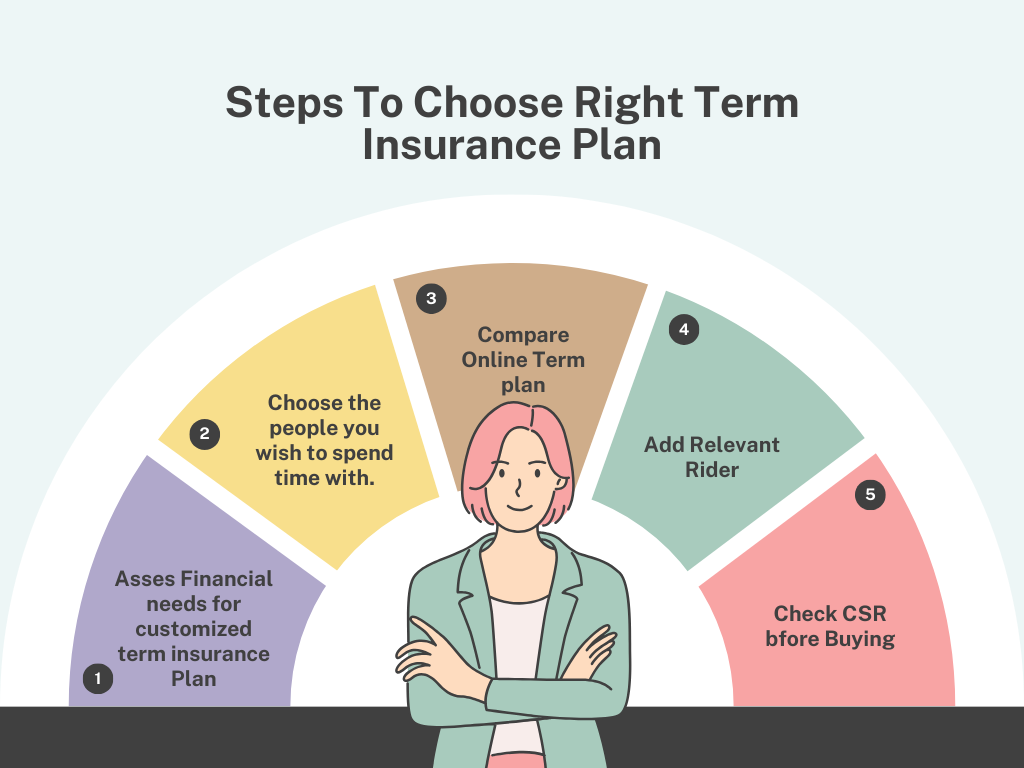

How To Choose Right Term Term Insurance Plan?

What are Different Types of Term Plan and their Benefits?

TYPES OF TERM PLAN

The right time to buy term insurance plan is early as possible. this is because the premium increase with age and changing health condition.

as you grow older your health condition deteroite as premium increase. buying a annual term plan allow you to secure your family at affordable premium with a large life cover for long tenure.

Suppose a family has 3 breadwinner , the husband earns 30,000 per month of which 8 thousand spent on child fee and 9 thousand on rent and remaining thirteen thousand spent on monthly expenses like groceries , bills etc.

if the husband death wife will be no source of income and still required at least 30000 to maintain their current lifestyle. in such case if the husband already had a 1 crore sum assured to help take care of monthly expenses.

Before Buying Term insurance it is essential to determine the right life cover for your profile. you can use a human life calculator to estimate the sum assured you are eligible to buy. An HLV calculator uses your current annual income, age, and cover of existing life insurance to provide you with the right term insurance cover amount.

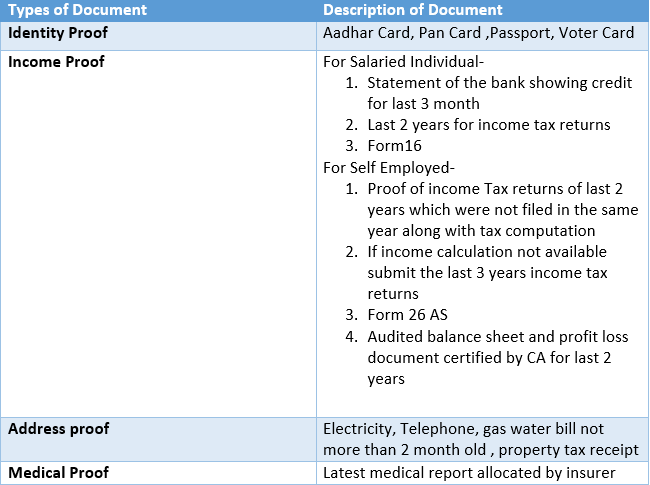

Document Require To Buy Term Insurance Plan?

What are the Types of Term Life Insurance Riders?

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

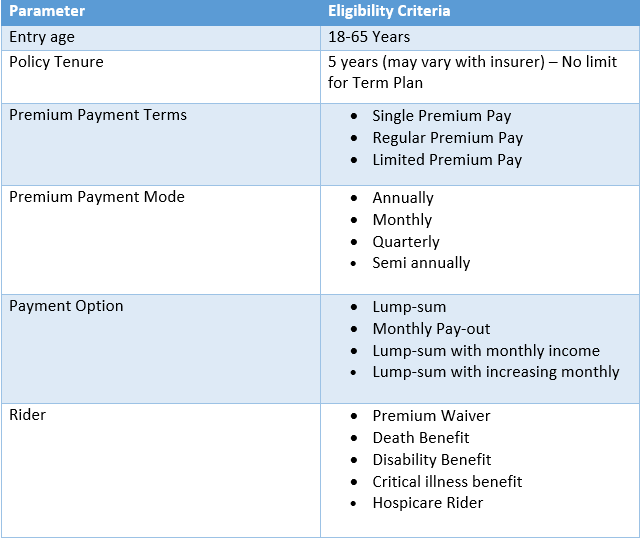

Eligiblity Criteria To Buy Term Insurance Plan

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!