Life Insurance

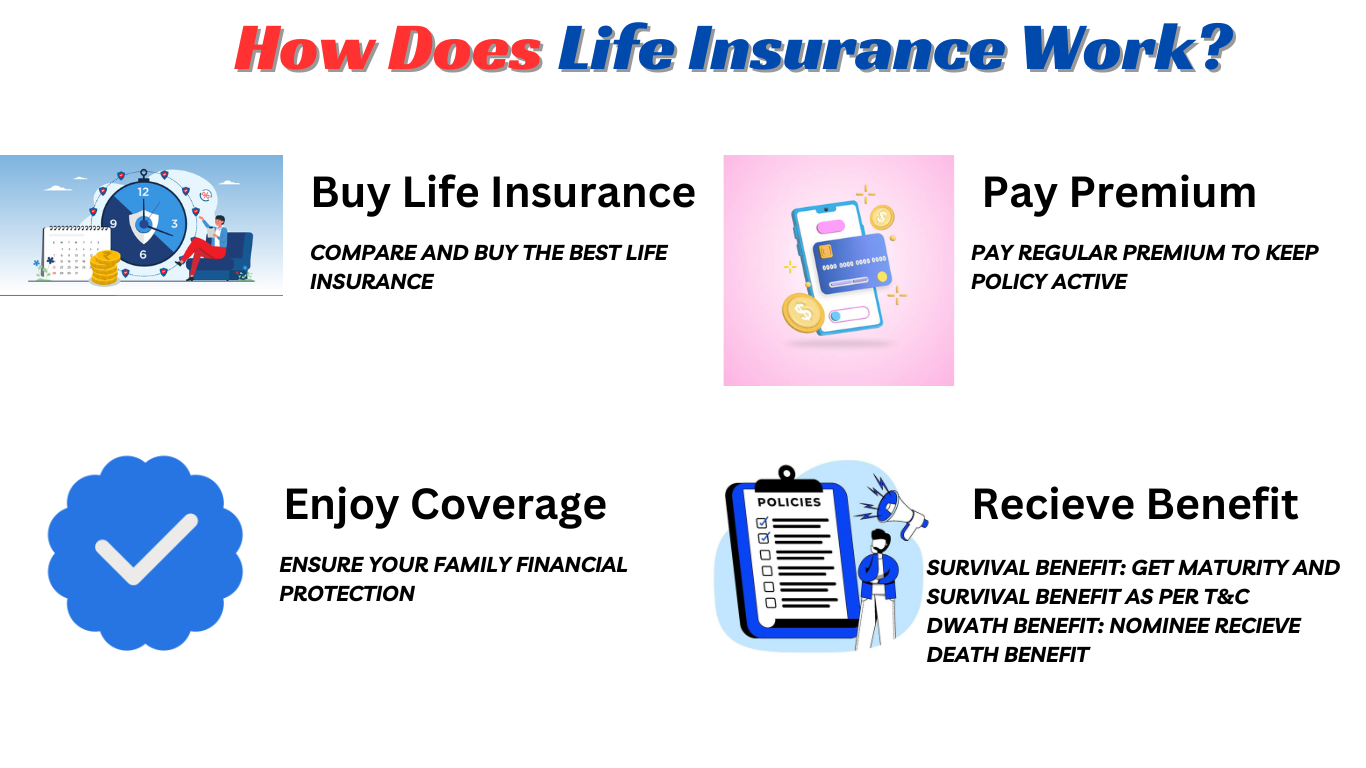

A Life Insurance policy is a contract between insurer and policyholder wherein the insurer promise to pay a life cover in return for regular premium paid by the insured.

This Life cover secure your dear one future by paying a lumpsum in case of an unforseen event. In some Plans the maturity benefit is paid at the end of policy term.

What is Life Insurance Policy? What is its meaning and definition?

A Life Insurance Policy is an agreement between an insurance Company and policyholder Where the life insurer promise to pay a fixed amount of money in exchange for premium paid periodically after a set time period or upon the life insured death.

There are two type of Life Insurance Policies:

- Pure Protection Plan: Pure Protection Plan also known as term Insurance Plan, are design to protect your family future by providing a lumpsum Payment in case of your untimely demise.

- Saving Plan: A Saving Plan is Financial product that help you plan long term goal like buying a home fees for children higher education and more while providing life coverage benefit.

Type of Life Insurance Policies in India

Term Insurance

Type of Life Insurance Policies in India

Investment Plan

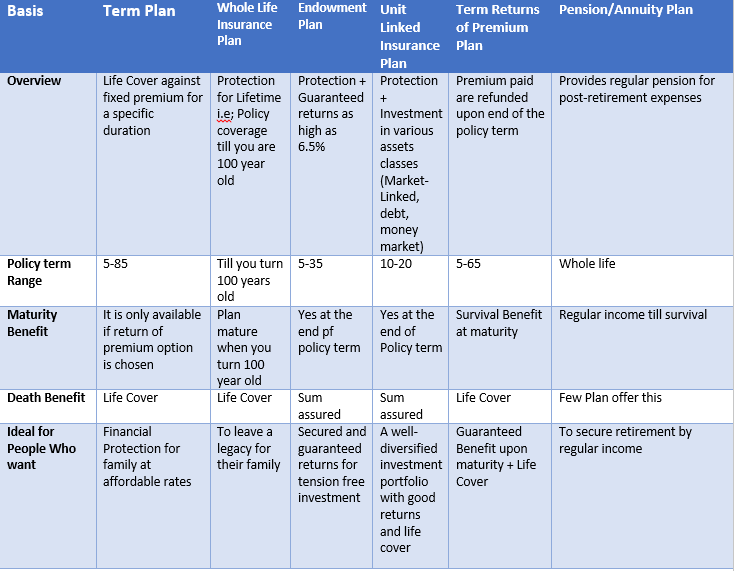

Comparison Life Insurance Plan in India

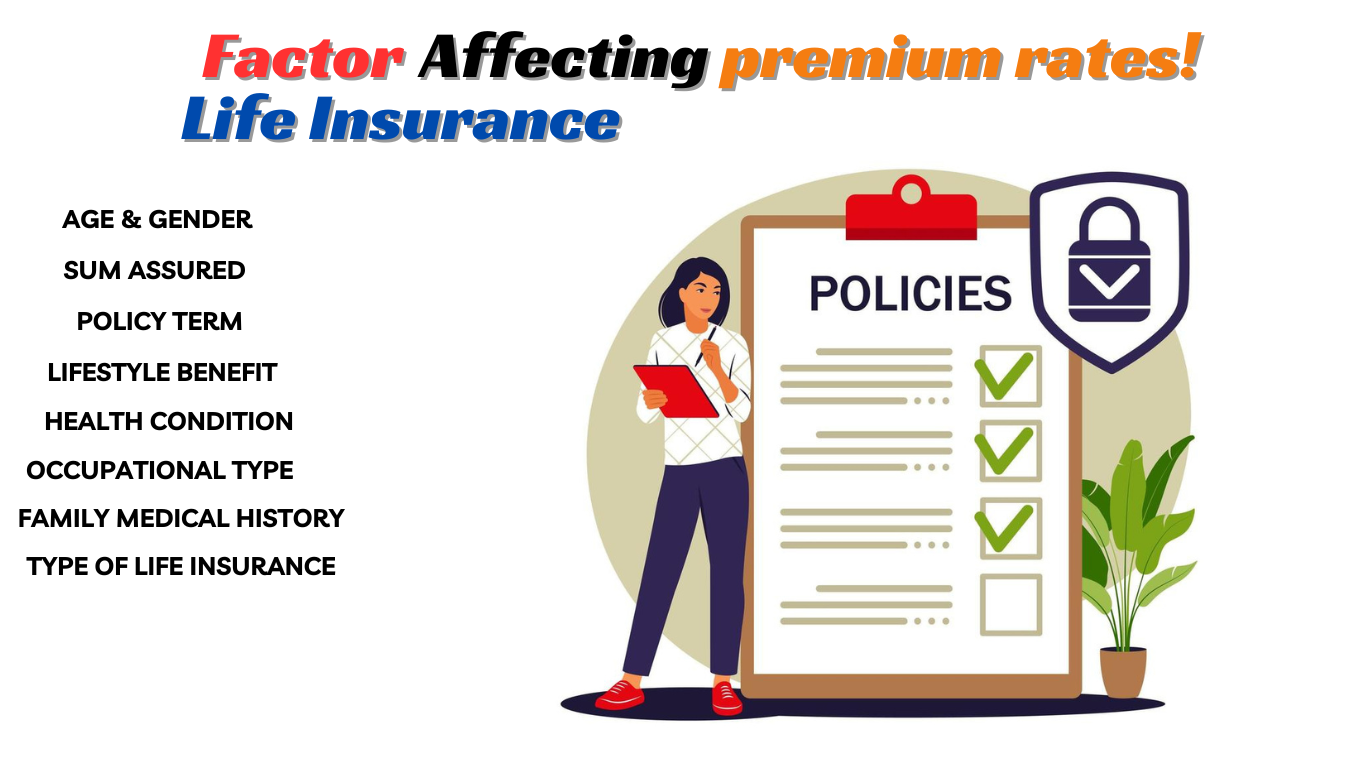

Important Terms About Life Insurance

Who Should BUY Life Insurance Plan

How Much Life Insurance Cover do you need?

- Your Family need- you need to asses your family financial need like total income and total monthly expenses before finding the right life cover.

- HLV Calculation- While selecting the suitable sum assured you need to use the human life value calculator to get an accurate estimate of your required life cover.

- Income Replacement- you should choose a sum assured that can be paid in monthly installment to easily replace your income in your absence.

- Existing Loans and Debt- the life cover you select should be enough to pay off any remaining loans or debt that you may arise and thus choose a life cover large enough.

What are type of Death not Covered in Life Insurance?

- Death due to criminal/high risk activities- in case you are involved in illegal or criminal activites the insurer will not pay the nominee the death benefit on your untimely death. not only that death caused due to high risk sports will also not be covered.

- Pre-existing Illness- Death due to pre-existing illness is usally not covered in life insurance. this is why most insurers require you to declare any pre-existing illness you might have at the time of policy purchase.

- Death due to intoxication- in case of policyholder passes away due to overdose or intoxication the insurer will not provide any benenfit amount to the nominee of the policy. death due to driving under the influence of alcohol is also not coverd.

- Death due to natural calamities- most life insurers plan do not cover death cause due to natural calamities. however it is better to check policy document to get a clear idea of a type of death covered under a life insurance plan.

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

life insurance plans which take care of expense of your family in your absence in the form of huge life cover for a very small premium

The right time to buy term insurance plan is early as possible. this is because the premium increase with age and changing health condition.

as you grow older your health condition deteroite as premium increase. buying a annual term plan allow you to secure your family at affordable premium with a large life cover for long tenure.

Suppose a family has 3 breadwinner , the husband earns 30,000 per month of which 8 thousand spent on child fee and 9 thousand on rent and remaining thirteen thousand spent on monthly expenses like groceries , bills etc.

if the husband death wife will be no source of income and still required at least 30000 to maintain their current lifestyle. in such case if the husband already had a 1 crore sum assured to help take care of monthly expenses.

Before Buying Life insurance it is essential to determine the right life cover for your profile. you can use a human life calculator to estimate the sum assured you are eligible to buy. An HLV calculator uses your current annual income, age, and cover of existing life insurance to provide you with the right term insurance cover amount.

it offers a plan of return of premium. in case you choose this option all the premium paid excluding GST is paid back as survival benefit in case the policyholder survive the policy term.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!