Home Loan

A home loan is a secured loan where the borrower offers their home as collateral. The borrower receives a lump sum of money from the bank, which they repay in monthly installments (EMIs) over a set period of time. it is a secured loan that is obtained to purchase a property by offering it as collateral. Home loans offer high-value funding at economical interest rates and for long tenures. They are repaid through EMIs.

How to get Home Loan in 6 easy steps?

Eligibility Criteria Home Loan

Home Loan Documents

4 things

Availing a home loan requires providing documents to verify your identity, income, and the details of the property. This helps us process your loan smoothly and tailor it to your needs. Here are the documents you need:

- Identity proof or KYC documents such as Aadhaar card, Passport

- Proof of residence

- Salary slips, Bank statements, ITR for proof of income

- Property documents or sales deed

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Loan Calculator

**Note: For exceeding 120 no. of payments, a group of 12 payments will be combined into a single payment number for better chart visibility.

| Period | Payment | Interest | Balance |

|---|

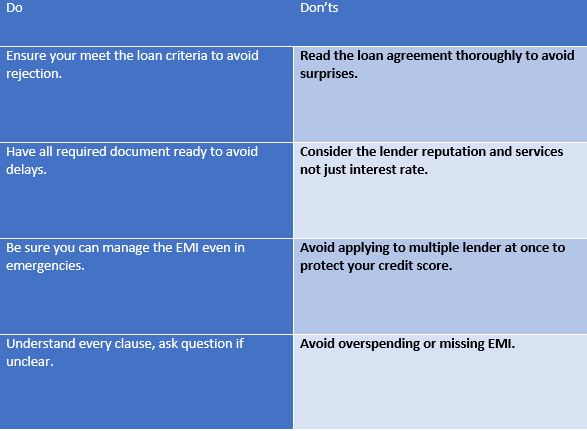

Do and Don'ts why applying for Home Loan

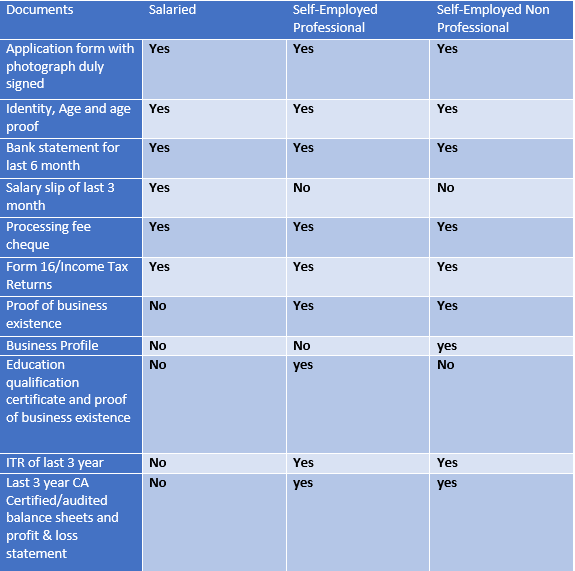

List of Document Required for Home Loan

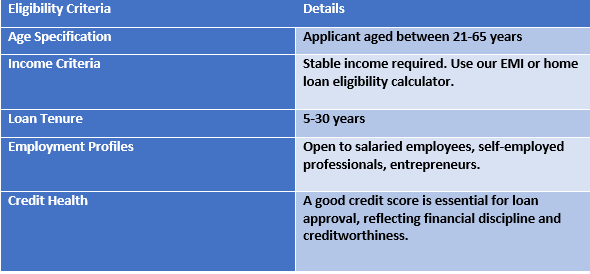

Eligiblity Criteria For Home Loan

Talk to an Advisor Right away!

Not Sure Which Loan To Take?

we help to choose best loan based on your need.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!

A home loan is a secured loan where the borrower offers their home as collateral. The borrower receives a lump sum of money from the bank, which they repay in monthly installments (EMIs) over a set period of time. it is a secured loan that is obtained to purchase a property by offering it as collateral. Home loans offer high-value funding at economical interest rates and for long tenures. They are repaid through EMIs.

There are steps to get loan -

- Determine your Requiremts

- Check loan eligiblity

- Calculate Monthly Installment

- Fill the Document

- Sumbit the Document

- Enjoy the loan

there are documents-

- ID Proof

- Proof of residence

- Salary Slips, Bank Statement, ITR for proof of income

- Property Document or sales deed

there are factors affecting-

- Cibil Score

- Repayment History

- Income

- Employer Reputation

- Debt to Income Ratio

The criteria for home loan -

- age should be between 21 to 58

- Monthly income 1lakh to 10 lakh

- Minimum one year work experience