Bike Insurance

Bike insurance protect the insured bike from loss caused by accident, theft , natural manmade disasters. it also cover the insured bike owner from any third part liability that may occur in a road accident. hence a bike insurance cover expenses for motorcycle, mopeds, and scooter caused by several unforseen circumstances.

What is Bike Insurance?

Bike Insurance provides financial protection to the insured bikes during accident, theft and other incident.

According to the motor vehicle act 1988 third party bike insurance is compulsory for all type of two wheelers. A 3rd party bike insurance policy protect the bike owner in the event of road accident that cause damage to the other party or person.

therefore buying or renewing bike insurance is highly advisable to ensure compliance with legal requirement and avoid challan. remember this policy not only provides financial protection but also ensures adherence to regulatory standard.

Bike insurance premium rate in India?

Bike Insurance premium based on coverage and engine cubic capacity of a two wheeler.

Apart from this there are varius factor to decide the bike insurance premium rate. however thord part bike insurance policies have uniform rate among all insurers since IRDAI determine it.

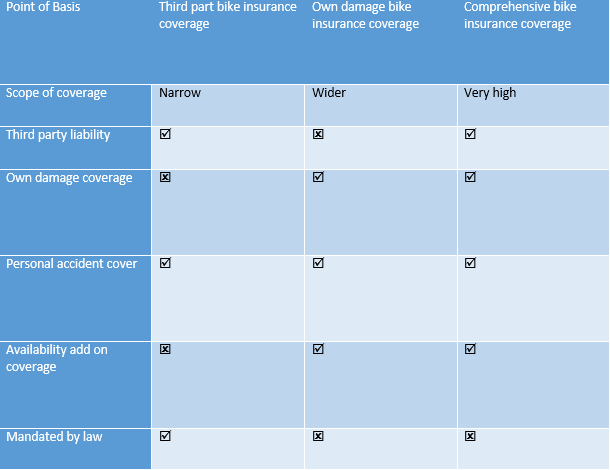

Third Party vs Own Damage vs Comprehensive Bike Insurance

Covered under Bike Insurance Policy

- Natural man made Disaster coverage – Any loss or damage caused to the insured vehicle due to natural calamities such as lightning , earthquake , flood, cyclone will be covered etc. in addition it offers coverage against the damage caused due to various manmade disasters, such as riots , strikes by outside means , malicious act , territory activity and any damage caused in transit by road , rail , inland waterway , lift ,elevator or air.

- Own damage coverage – this cover safeguards the insured vehicle against any loss or damage caused by accident, fire, self ignition or explosion

- Theft or burglary coverage- the policy will compensate the owner if the insured motor vehicle or scooter get stolen.

- Third party liability coverage- it offer cover against any legal loss of money due to injuries to third party in the surrounding which may have even lead to their demise. similarly it protect against any damage caused to any third party Property.

Benefits of Bike Insurance

Security

Document Require Bike Insurance Policy

- Aadhar Card

- Passport

- Driving License

- Pan

- Voter card

- Ration Card with photo of applicant

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

Yes as per motor vechile act 1988 all two wheeler owner must hold at least a third party bike insurance company

comprehensive bike insurance offer both third part coverage and damage cover you should consider policy. however if you have a old bike, buying a third party policy will be the most convenient & affordable option.

the insured vechile is financially covered against several unforseen risk in first party insurance.

that is why it is also known as damage cover. in contrast 3rd part insurance policy cover the losses or damage caused to third party, property, person in a road accident. it is advised to purchase a comprehensive bike insurance policy as it cover both first party and third party.

In bike insurance 2nd party refer to the insurance company which provide insurance services to the customer in exchange for the premium amount.

As per motor vehicle act 1988 purchasing first party insurance for your bike is not compulsory in India.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!