Third party car insurance also known as liability only policy is a mandatory car insurance policy as per the Indian motor laws. this type of insurance policy provide financial and legal coverage against third party death, injury and property damage arising due to insured car.

The compensation is offered in case of third party death is unlimited, while for property damage it’s limited . this policy does not cover any damage sustained by insured car.

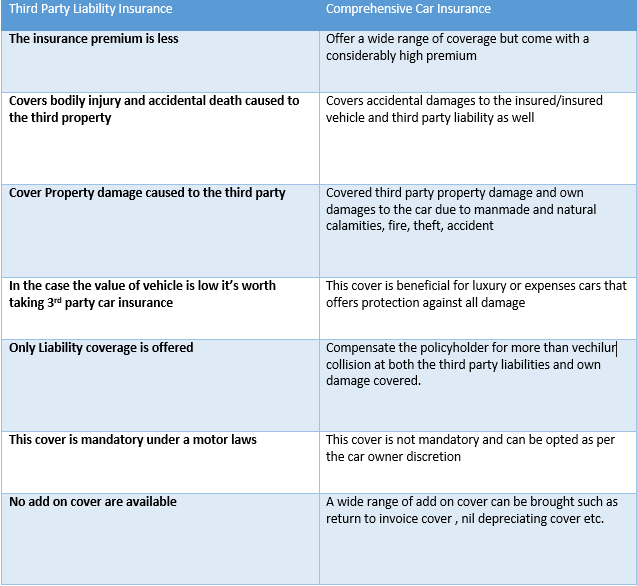

Comprehensive vs Third Party Insurance Coverage

How to Claim Third Party Insurance?

Step1: Application

the victim or the legal hier of the departed can make a application against the owner of vechile for third party liability compensation.

Step2: Lodged an FIR

Once the application is completed file and FIR with the police, furnishing with required details. he/she must have the copy of the FIR and the original records of the expense incureed by the victim.

Step3: Approach the Motor accident Claims Tribunal

after filing the first information report successfully the next step is to register the case with Motor accident claim tribunal.

Get the Cover amount

the compensation amount is not pre decided. the insurer compensate the full amount decided by the court of law. however IRDAI limit the coverage for property damage.

Note- the police complaint must have following information-

- Driving License Number

- Witness name and Contact details

What are type of car insurance i can avail in India?

the primary category of car insurance include two type – third party car insurance, comprehensive car insurance or own damage car insurance. 3rd party car insurance is mandatory in india while the others are optional.

apart from these there are personal accident cover and other add on coverage such as zero depreciation cover, roadside assistance cover, NCB protection and so on.

As a part of this policy what is the highest compensation offered?

in the case of death or bodily injuries there is no particular ceiling with reference to the amount of compensation. however in the case of damage to the property of the third party the insurance company will compensate for maximum amount.