SIP - Systematic Investment Plan

A systematic investment plan is a plan of discipline investment in market linked fund like unit linked insurance plan and mutual funds. various insurance companies, fund companies and other financial institution offer SIP investment fund to invest in India. SIP investment plan offer by these fund management institution have given very high return to discipline investor even during volatile market scenario.

What is SIP?

The full form of SIP is Systematic Investment Plan. an SIP plan is a popular investment strategy that allow you to invest and allocate a small amount of money at regular intervals into a specific ULIP fund or a mutual fund scheme.

so what is SIP?

it is a smart and Hassel free mode of investing money in the following investment option-

Mutual Fund- here you are allowed to contribute a predetermined sum of money monthly, quarterly and weekly.

ULIP- here you can avail yourself of all the ULIP fund portfolio with the regular payment of policy premium at monthly, quarterly and half-yearly frequencies.

when you opt for SIP plan, you authorize the ULIP fund house, mutual fund company or assets management firm to automatically deduct a predetermined amount from your bank account on a selected date at the chosen interval.

SIP Investment Process

Learn the working of SIP investment plan for achieving maximum return with minimum investment from the step below-

Step1- Learn in depth about best SIP plan in which you are planning to invest.

Step2- Start by selecting a fund plan that align with your financial goals and risk profile.

Step3- Either invest in a mutual Fund or suitable ULIP policy through a systematic investment plan.

Step4- Decide on the frequency and amount of your investment in a SIP plan.

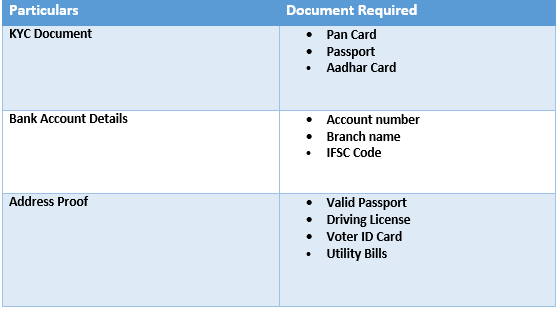

Step5- Complete your KYC authentication carefully. also provide the bank account details with auto debit facility activation for Hassel free and non interpreted investment SIP investment.

Step6 – once the systematic investment plan activates the SIP investment allocated to the chosen ULIP fund or mutual fund scheme based on your investment preference.

Step7 – the fund manager will then invest the accumulated amount in various assets , such as stock, bond, hybrid fund and index fund based on investment objective of the scheme.

Step8 – on the specified date of SIP plan the amount deducted from your bank account is utilized to purchase unit of the ULIP fund or mutual fund scheme at the prevailing Net asset value .

Step9 – you have the flexibility to increase, decrease, stop your investment plan contribution at any time by providing the necessary instruction to the relevant fund house.

Step10 – use the calculator to get the idea of returns

What are Document Require for SIP investment?

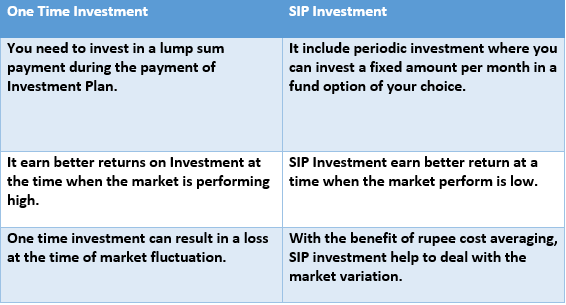

Which is Better : SIP or One Time Investment?

How To Choose Best SIP Investment in India

Six Ways

Duration of SIP – while investing through investment plan, you should keep a reference point of at least 5 year back and check how the fund perform across the market.

Fund House Performance- the reputation and fund house of your SIP plan will give you estimation of how well the fund manager will be able to handle the market low and high without letting you feel the impact.

Set Investment goal – Every SIP Investment Plan and ULIP plan has set purpose and goal. according to your objective and requirement you can choose fund investment option.

Select the Right Plan – as there is a wide range of Investment plan available in market you should select the right plan by checking past performance of fund.

Diversify your Portfolio – it is advised to invest small amount in multiple fund units rather than focusing on rather just 1 . this helps nullify the market fluctuation and earn maximum return from your SIP investment Plan.

Periodic review your Investment- Review your SIP investment plan strategy periodically and make any adjustment if required to align with your changing fianancial goals.

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

A systematic investment plan is a plan of discipline investment in market linked fund like unit linked insurance plan and mutual funds. various insurance companies, fund companies and other financial institution offer SIP investment fund to invest in India. SIP investment plan offer by these fund management institution have given very high return to discipline investor even during volatile market scenario.

Duration of SIP - while investing through investment plan, you should keep a reference point of at least 5 year back and check how the fund perform across the market.

Fund House Performance- the reputation and fund house of your SIP plan will give you estimation of how well the fund manager will be able to handle the market low and high without letting you feel the impact.

Set Investment goal - Every SIP Investment Plan and ULIP plan has set purpose and goal. according to your objective and requirement you can choose fund investment option.

Learn the working of SIP investment plan for achieving maximum return with minimum investment from the step below-

Step1- Learn in depth about best SIP plan in which you are planning to invest.

Step2- Start by selecting a fund plan that align with your financial goals and risk profile.

Step3- Either invest in a mutual Fund or suitable ULIP policy through a systematic investment plan.

Step4- Decide on the frequency and amount of your investment in a SIP plan.

Step5- Complete your KYC authentication carefully. also provide the bank account details with auto debit facility activation for Hassel free and non interpreted investment SIP investment.

Step6 - once the systematic investment plan activates the SIP investment allocated to the chosen ULIP fund or mutual fund scheme based on your investment preference.

Step7 - the fund manager will then invest the accumulated amount in various assets , such as stock, bond, hybrid fund and index fund based on investment objective of the scheme.

Step8 - on the specified date of SIP plan the amount deducted from your bank account is utilized to purchase unit of the ULIP fund or mutual fund scheme at the prevailing Net asset value .

Step9 - you have the flexibility to increase, decrease, stop your investment plan contribution at any time by providing the necessary instruction to the relevant fund house.

Step10 - use the calculator to get the idea of returns

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!