ULIP - Unit Linked Insurance Plan

The Term ULIP stands for Unit Linked Insurance Plan, which type of insurance plan offering. The scheme enables you to invest and achieve your long term financial goals. In addition it also offers a life cover that ensure financial security for family in the event of unfortunate incident.

What is ULIP?

ULIP combine insurance and investment. A portion of premium provide life coverage , while the rest is invested in various fund. they offer flexibility, tax benefit and a unique approach to achieve financial goals.

When you invest in ULIP plan, a part of premium goes towards providing you with life insurance coverage , while the rest is invested in different large cap, middle cap, small cap, flexi cap fund of your choice. this make ULIP plan a unique investment option that can help you achieve your financial goals while also protecting your loved ones in case of an unforeseen event.

you hold the power to select from a diverse range of option – equity, debt or both.

ULIP are popular because they offer flexibility to policyholder to choose and allocate fund according to their risk appetite and financial goals. additionally ULIP plan offer tax benefit under the Income Tax act 1961.

How To Choose Best ULIP Plan

Three Ways

Here are the features and benefits of ULIP Explained

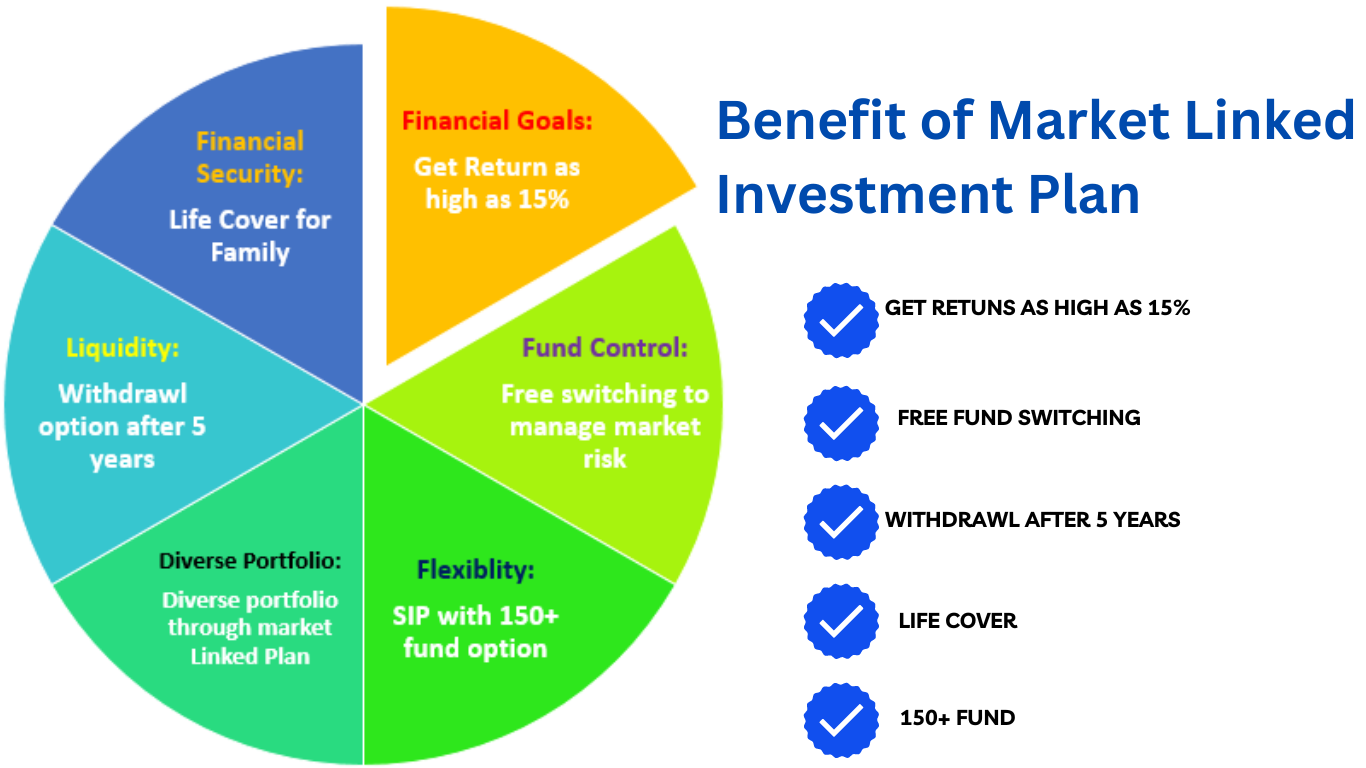

- Dual Benefit – with ULIP plan you get the dual benefit of insurance and investment. while a portion of your premium ensures you’re covered with life insurance , the other part is invested in various fund of your choice.

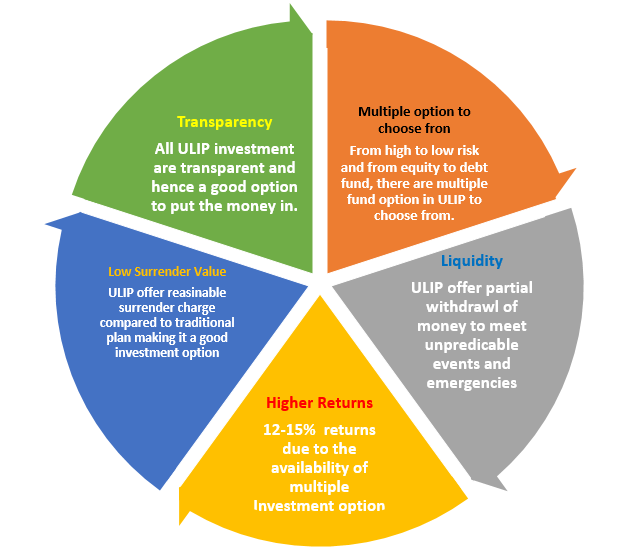

- Flexibility to switch fund- ULIP don’t lock you into one investment strategy . you can switch between different ULIP funds based on your investment objective and risk tolerance . this means you can regularly tailor your investment portfolio to aim for the best returns.

- Protecting your child Future- Considering your child future? Child ULIP plan are crafted precisely for this purpose. they come with a standout feature the “Waiver of Premium”. if something were to happen to you like a critical illness or disability this feature ensure your child policy remain active. Future Premium? They waived off and the policy continues as initially agreed.

- Lock in Period – ULIP have a 5 year , you can make partial withdrawal to meet any unforeseen financial needs.

- Transparency- you always knows where your money is going. detailed statement show you the charge applied, the amount invested and the insurance coverage you have.

- Liquidity- After the initial lock in period which is 5 years you can make partial withdrawal to meet any unforeseen financial needs.

Types of ULIP Plan?

ULIP are Classified based on purpose and death benefit.

- Classification by Purpose – various ULIP types including Retirement ULIP , Wealth collection ULIP , Children Education Plan, and Health ULIP Plan, helping to meet diverse financial need and goals.

a). ULIP Plan for Retirement – with whole life plan ULIP you have an effective retirement planning tool. the investment component of these plan lets you accumulate a significant corpus for long term. imagine having a substantial amount is ready for your retirement needs paid out to you in the form of annuities once you retire.

b). ULIP Plan for Wealth Creation – are you in your late twenties or early thirties? ULIP could be your ticket to accumulate wealth over time. by investing in this plan you gain the flexibility to fund your future financial goals. think of it as a strategic move to secure your financial future.

c). ULIP Plan for Children Education – As a parent don’t you want the best for your child education? ULIP pan design for children come with a waiver premium features. this feature that your policy continues without any hitches making sure the financial goals you’ve set for your child future remain uncompromised.

d). ULIP Plan for Heath Plan – Did you know that ULIP offer more than just common benefits ?They efficiently provide financial assistance to tackle medical emergencies. so when health challenges arise you have a financial cushion to fall back.

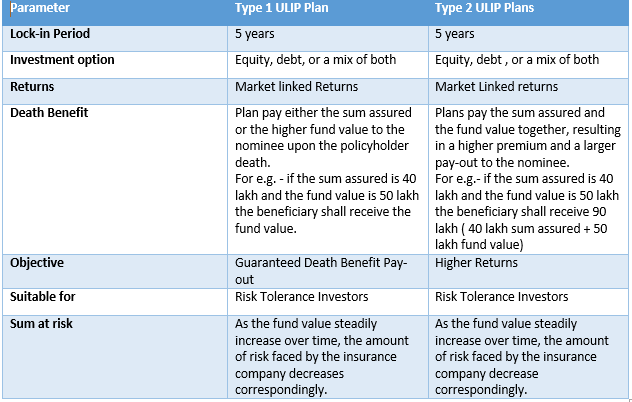

2. Classified by Death benefit – ULIP Plan come in two ways- Type 1 Prioritize life coverage with a higher payout on demise , while Type 2 emphasize investment , offering the fund value on death. Both types allow customizable for diverse financial goals.

Types of ULIP Fund?

ULIP Plan offer diverse fund option like equity, debt and hybrid funds.

these define are-

- equity Funds- Invest in stocks of companies , aiming for high returns but with higher risk due to market fluctuation. Good for long term goals and those comfortable with risk.

- Debt Fund- Invest in fixed income instrument like bonds, offering stable returns with lower risk. suitable for those seeking capital preservation and predictable income.

- Hybrid Fund- A mix of equity and debt fund , balancing risk and return. they offer moderate growth potentially with stability. ideal for those who want some equity exposure but with a risk buffer.

Why ULIP can save for LONG term

What isULIP NAV?

ULIP NAV or Net assets value is the value of a single unit of a ULIP fund. it signifies the unit current worth which is important for assessing investment performance and determining policyholder returns. ULIP NAV is calculated by dividing the total value of fund assets by the number of outstanding unit.

ULIP NAV is important because it determine the value of your investment. when you invest in ULIP you buy unit at the current NAV. The value of your investment will increase or decrease depending on the performance of the fund and the changes in the NAV.

ULIP NAV is calculated and published daily by insurance company. you can find the NAV of your ULIP fund on the insurance company website or in the fund fact sheet.

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

ULIP NAV or Net assets value is the value of a single unit of a ULIP fund. it signifies the unit current worth which is important for assessing investment performance and determining policyholder returns. ULIP NAV is calculated by dividing the total value of fund assets by the number of outstanding unit.

ULIP NAV is important because it determine the value of your investment. when you invest in ULIP you buy unit at the current NAV. The value of your investment will increase or decrease depending on the performance of the fund and the changes in the NAV.

ULIP NAV is calculated and published daily by insurance company. you can find the NAV of your ULIP fund on the insurance company website or in the fund fact sheet.

ULIP Plan offer diverse fund option like equity, debt and hybrid funds.

these define are-

- equity Funds- Invest in stocks of companies , aiming for high returns but with higher risk due to market fluctuation. Good for long term goals and those comfortable with risk.

- Debt Fund- Invest in fixed income instrument like bonds, offering stable returns with lower risk. suitable for those seeking capital preservation and predictable income.

- Hybrid Fund- A mix of equity and debt fund , balancing risk and return. they offer moderate growth potentially with stability. ideal for those who want some equity exposure but with a risk buffer.

ULIP are Classified based on purpose and death benefit.

- Classification by Purpose - various ULIP types including Retirement ULIP , Wealth collection ULIP , Children Education Plan, and Health ULIP Plan, helping to meet diverse financial need and goals.

a). ULIP Plan for Retirement - with whole life plan ULIP you have an effective retirement planning tool. the investment component of these plan lets you accumulate a significant corpus for long term. imagine having a substantial amount is ready for your retirement needs paid out to you in the form of annuities once you retire.

b). ULIP Plan for Wealth Creation - are you in your late twenties or early thirties? ULIP could be your ticket to accumulate wealth over time. by investing in this plan you gain the flexibility to fund your future financial goals. think of it as a strategic move to secure your financial future.

c). ULIP Plan for Children Education - As a parent don't you want the best for your child education? ULIP pan design for children come with a waiver premium features. this feature that your policy continues without any hitches making sure the financial goals you've set for your child future remain uncompromised.

d). ULIP Plan for Heath Plan - Did you know that ULIP offer more than just common benefits ?They efficiently provide financial assistance to tackle medical emergencies. so when health challenges arise you have a financial cushion to fall back.

2. Classified by Death benefit - ULIP Plan come in two ways- Type 1 Prioritize life coverage with a higher payout on demise , while Type 2 emphasize investment , offering the fund value on death. Both types allow customizable for diverse financial goals.

- Dual Benefit - with ULIP plan you get the dual benefit of insurance and investment. while a portion of your premium ensures you're covered with life insurance , the other part is invested in various fund of your choice.

- Flexibility to switch fund- ULIP don't lock you into one investment strategy . you can switch between different ULIP funds based on your investment objective and risk tolerance . this means you can regularly tailor your investment portfolio to aim for the best returns.

- Protecting your child Future- Considering your child future? Child ULIP plan are crafted precisely for this purpose. they come with a standout feature the "Waiver of Premium". if something were to happen to you like a critical illness or disability this feature ensure your child policy remain active. Future Premium? They waived off and the policy continues as initially agreed.

- Lock in Period - ULIP have a 5 year , you can make partial withdrawal to meet any unforeseen financial needs.

- Transparency- you always knows where your money is going. detailed statement show you the charge applied, the amount invested and the insurance coverage you have.

- Liquidity- After the initial lock in period which is 5 years you can make partial withdrawal to meet any unforeseen financial needs.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!