Child Education Plan

Child education plan are financial product that combine the benefit of saving and insurance. these plan are designed to help parents in saving and investing for their children future education expenses. simultaneously they provide financial security in case of an unfortunate event.

What is Child Education Plan?

Child education plan are espicially designed to help parents financially secure their child future in a disciplined way. In a children education plan you pay premium (monthly, half yearly, yearly, single pay) for a specific period. at the end of policy term you get a lump sum amount as the maturity benefit. while you create a corpus for a child education the insurance element provides you with life cover.

In case of an unfortunante death of a parents (policyholder) a child plan will support nominee with triple benefit. while the life cover amount is paid to family the remaining premium of the plan are paid by the insurer.

Also the child get benfit of a monthly payout to meet his/her expenses. that means even in your absence the child can use this amount to cover educational cost such as tuiton fees, books, uniforms, etc. beside child education offer flexible payout option at important milestone of your child.

Why Buy Child Education Plan?

In case of the policyholder untimely death child plan provide triple benefit for complete protection.

- The life cover is paid to the nominee/family member to meet immediate expenses.

- Future premium amount of the market linked child plan are paid by insurer. upon maturity the amount is paid to the child.

- The Child get monthly income to meet regular expenses.

Features of Child Education Plan

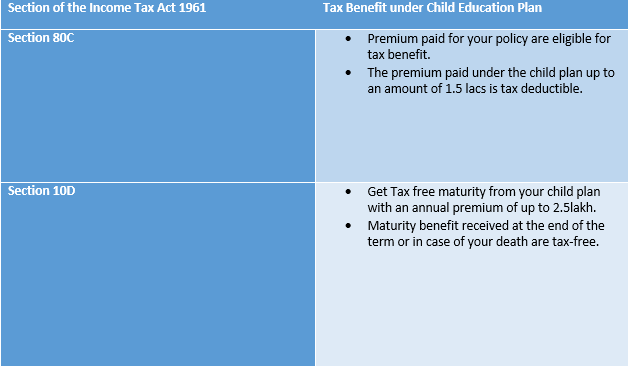

Tax Benefit on Child Education Plan

Why Life Cover is Important?

Here is why life cover is important-

- Financial security for your child- In the unfortunate event of your death, life cover in a child plan will provide your child with a financial cushion to meet their needs. this can help them to achieve their goal even if you are not there to support financially.

- Peace of mind for you- knowing that your child is financially secure in case of your death can give you a peace of mind. this can allow you to focus on other aspect of life such us your carrier and your family.

- Affordability- Life cover in a child plan is relatively affordable especially when you consider the long term benefits it provides. you can choose a life cover amount that fits your budget and your child needs.

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

A child education plan is a financial product designed to help parents and save and invest money to fund their child education expenses.

In India tax benefit of child education plan depend on the plan to choose.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!