Investment Planning

Investment Planning is a key aspect of financial planning , aimed at growing you saying through disciplined investment. it's important to choose the best investment plan with high return to provide direction and make a effective strategy for achieving your financial goals in a timely manner. high returns investment can significantly boost your financial growth helping you reach your objective more effectively.

What is Investment Plan?

Investment plan are financial product that help you create wealth for the future. these plan allow you to invest in different schemes and funds in a periodic and systematic way to fulfill your financial objective.

The first step towards having a Investment Plan in India is to determine your financial need and risk profile. Then choose the best investment investment plan that suits your need.

some of the best investment option in India include-

- ULIP

- Senior Citizen Saving Scheme

- Monthly Income Plan

Benefit of Choosing Investment Plan

- Goal Based Planning- Investment allow you to set specific financial goals and create a structural plan to achieve them. Whether you’re saving for your child education, buying a house , planning for retirement or starting business , investment plan provide a discipline approach to help you reach your goal within a limited time frame.

- Wealth Creation- Investing your money wisely can potentially generate substantial wealth over time. by putting your funds into investment vehicle such as ULIP you have the opportunity to earn higher returns compared to traditional saving account. over the long term these investment can help you build wealth and increase your net worth.

- Flexiblity- Investment plan offer flexibility in terms of contribution amount and investment option. you can typically choose how much money to invest and adjust your contribution based on your financial circumstance. Moreover investment plan offer range of investment vechile to suit your risk tolerence and investment preference allowing you to diversify your portfolio and adapt to changing market condition.

- Inflation protection- one of the significant advantages of investment plan is their potential to outpace inflation. Inflation erodes the purchasing power of money over time reducing the value of saving. by investing in assest that have historically provided higher returns than the inflation returns than the inflation rate you can mitigate the impact of inflation. thus it help you to maintain the value of your wealth.

- Tax Benefit- Investment plan not only provide opportunity to create wealth in a long term but also offer substantial tax saving benefit under section 80C and 10D of the income tax.

Factor Consider Choosing Investment Plan

The Factors are-

- Define your Financial Goals- tailor your investment choice to meet objective like buying a home , funding education , or retirement and adjusting for risk based on time horizon.

- Mind the Cost- Watch out for fees such a management charges, brokerage fees, and loads that can reduce your returns. opt for investment with transeparent and reasonalble fees.

- Consider your department- Choosing investment that secure the financial future of your dependents , ensuring enough resources for their goals.

- Diverse investment option- When the pros and cons of various vehicle meet it give broad view to individual for returns.

- Evalute returns vs inflation – aim for investment that offer returns beating inflation to maintain your purchasing power , balancing potential rewards with associated risk.

When Should you start Investing?

The ideal time to start investing in the best investment plan with high returns is generally as early as possible. the power of compounding allow your investment to grow over time and the longer your money is invested the more it can potentially accumlate.

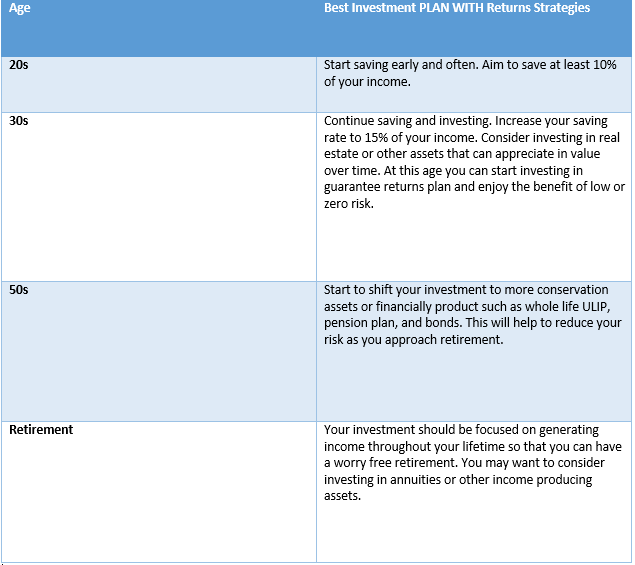

Here is a table of investment strategies for people in their 20s, 30, 50s and retirement phase:

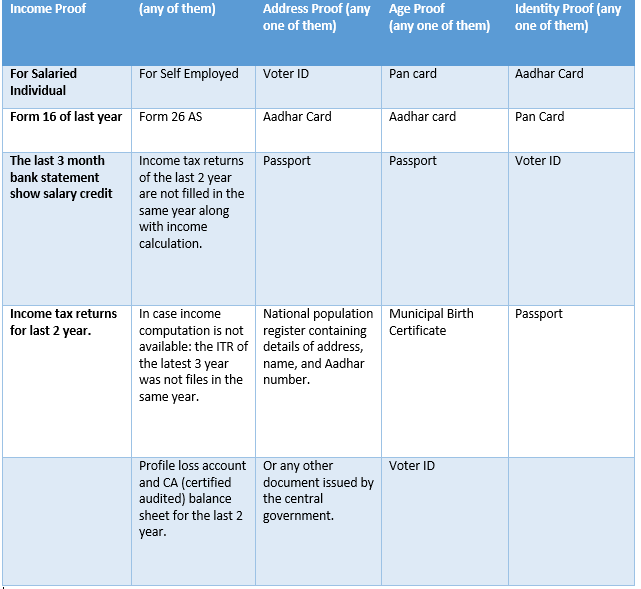

Document Require to Buy Investment Plan?

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

Investment allow you to set specific financial goals and create a structural plan to achieve them. Whether you're saving for your child education, buying a house , planning for retirement or starting business , investment plan provide a discipline approach to help you reach your goal within a limited time frame

Investing your money wisely can potentially generate substantial wealth over time. by putting your funds into investment vehicle such as ULIP you have the opportunity to earn higher returns compared to traditional saving account. over the long term these investment can help you build wealth and increase your net worth.

Investment plan offer flexibility in terms of contribution amount and investment option. you can typically choose how much money to invest and adjust your contribution based on your financial circumstance. Moreover investment plan offer range of investment vechile to suit your risk tolerence and investment preference allowing you to diversify your portfolio and adapt to changing market condition.

one of the significant advantages of investment plan is their potential to outpace inflation. Inflation erodes the purchasing power of money over time reducing the value of saving. by investing in assest that have historically provided higher returns than the inflation returns than the inflation rate you can mitigate the impact of inflation. thus it help you to maintain the value of your wealth.

Investment plan not only provide opportunity to create wealth in a long term but also offer substantial tax saving benefit under section 80C and 10D of the income tax.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!