Health Insurance

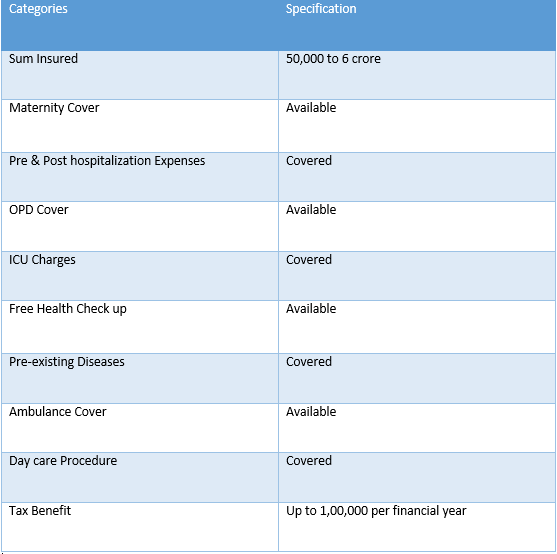

Health insurance is a type of insurance that cover medical expenses of the insured due to an illness or accident in exchange for a premium amount. it enable the insurance company to provide medical coverage for hospitalization expenses, day care procedure, critical expenses etc. A health plan offers also offers multiple benefit including cashless hospitalization and free medical check up.

What is Heath Insurance?

Heath Insurance is a contract between the policyholder and the insurer where the health insurance company provides financial coverage to the insured up to the sum insured limit. it offer medical coverage for healthcare expenses incurred during an emergency or planned hospitalization. it also provides tax saving on the premium paid to the insurance company under section 80D of the income tax1961.

Top reason to buy Health Insurance

Medical inflation is on rise making treatment expensive. if you get hospitalized for a critical illness or lifestyle disease you may end up losing all your saving. the only way to afford quality medical traeatment during a health emergency is by buying a health insurance policy.

take a look the reason to buy-

- Best Medical Infaltion - A health insurance policy can help you pay your medical bills, including pre and post hospitalization expenses , today as well as in future despite the rising medical cost.

- Afford Quality Medical Tratment- it help you to afford the best quality medical treatment and care so that you can focus only get cured.

Not Covered Health Insurance

The following medical expenses and situation are usually not covered in health insurance plan-

- Unless there is an accidental emergency, claim arising during the initial 30 days of buying a health insurance plan not covered.

- Coverage of Pre existing disease is subject to a waiting period of 2 to 4 years.

- Critical illness coverage usually comes with 90 days waiting period.

- Injuries caused by war/terrorism/nuclear activity

- Self inflicted injuries or suicide attempt

- Terminal illness and other disease of a similar nature

- Cosmetic/ Plastic surgery and replacement harmonious surgery

- Non accidental dental treatment

- Bed rest and rehabilitation

- Diagnostic test

- Claim arising out of adventure sport injuries

Health Insurance Riders

Document Require Health Insurance Claim

They are-

- Discharge card issued by hospital

- In patient hospitalization bills signed by insured for authenticity.

- Doctor prescription and medical store bills

- Claim form with insured signature on it

- Valid investigation report

- Consumables and disposable prescribed by doctors with complete details

- Bills of doctor Consultation

- Copies of health insurance policy from previous year and current year

- Copied of ID card

- any other document asked by TPA.

Document Require Health Insurance

They are-

- Aadhar Card

- Driving License

- Passport

- Votar ID Card

- Letter by National Population register with demographic details

- Job Card NREGA signed by a state government officer

- any other document notified by central government in consultation with the IRDAI.

Talk to an Advisor Right away!

Not Sure Which Insurance To Buy?

we help to choose best insurance based on your need.

there is no right time to buy health insurance. however it is suggested to buy it is possible at premium low.

No medical test required before buying a health insurance. most health insurance companies in india require medical test report if the age of the applicant is above 45 years. the type of medical test required can vary depending on the age of applicant and the insurer requirement.

cashless hospitalization means that in patient charges availed by insured and paid by the insurance company directly to the hospital. all insurance companies in india have a tied up with a large network of hospital where the insured/policyholder can avail cashless treatment for an illness or accidental injury.

you can include your children in a family floater from day 1 provided the child at least 90 days old. in maternity insurance plan newborn babies are covered from day 1 if the maternity claim was paid by the insurer. nonthless you are advised to go through the terms and condition of health plan carefully to know about the entry age for children.

yes you can buy more than one health insurance policy in India.

For eg- if you are covered under a corporate health plan, then you can get an individual or family floater health insurance policy as well. similiary if you already have individual haelth insurance you can get another top up health plan or a senior citizen health insurance plan for your parents.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!