Loan Against Property

A loan against property or Home Equity is a secured loan that helps you avail of credit using your existing property as collateral. A LAP loan has zero restrictions, which means you can use it to finance any big-ticket expense. With a loan on property, you can benefit from the value of the property while you continue to occupy it.

When you avail of a loan against property, you submit your property documents with us as collateral. This is also called a mortgage loan against property.

How to get LAP in 6 easy steps?

Why Choose Loan Against Property?

Eligiblity Criteria For Loan against property

Property Covered Under a Loan against property

4 things

With Gauranga Capital, you get multiple options to avail of a loan on property. These include-

- Loan against residential Property

- Loan against Commercial Property

- Loan against Industerial Property

- Loan against land/plot

To avail of a loan against property, the property must be self-owned by the borrower.

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Loan Calculator

**Note: For exceeding 120 no. of payments, a group of 12 payments will be combined into a single payment number for better chart visibility.

| Period | Payment | Interest | Balance |

|---|

Step By Step guide For Applying For a Mortgage loan with Gauranga Capital

Applying for a loan against property online is quick and easy. The first step is to check if you meet the following LAP eligibility criteria:

For Salaried Employees-

- You must be employed in an MNC, Public Ltd. Co., Large Pvt. Ltd. Co., State Govt., Central Govt., or PSU.

- Your age should be between 23 and 65 years or up to the age of retirement, whichever is earlier at loan maturity.

- The Monthly Net Income must be at least Rs. 1,00,000

- You should have a minimum of 3 years of occupational stability

For Self-Employed Individuals-

- You must be a doctor, architect, chartered accountant, trader, retailer, or wholesaler.

- The minimum age is 23 years, and the maximum is 70 years or the retirement age, whichever is earlier at loan maturity.

- Your annual income should be at least Rs. 12,00,000.

- You should have a minimum of 3 years of occupational stability.

If you meet these criteria, follow these steps to apply for a loan against property online with Gauranga Capital:

Step 1: Visit this website: https:

Step 2: Click on the “Apply Now” button on this page.

Step 3: Provide your personal and property details in the application form.

Step 4: Submit the application form along with the required documents.

That’s it! Once we successfully verify the application form and the submitted documents, the sanctioned loan amount will be disbursed to your account in no time.

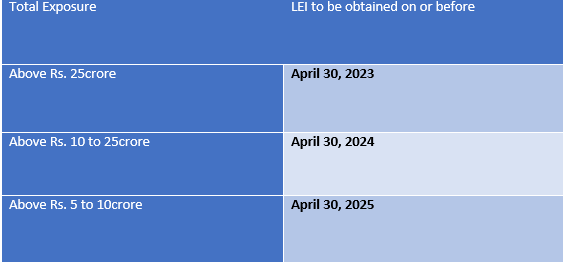

Important RBI/Regulatory Updates

Legal Identity Identifier (LEI) : If a non-individual borrower has an aggregate exposure of Rs. 5 crore and above from banks and financial institutions, then that borrower shall be required to obtain Legal Entity Identifier (LEI) code at the time of sanction. Borrowers who fail to obtain the LEI codes from an authorized Local Operating Unit (LOU) within the timelines mentioned below as per different exposure brackets shall not be sanctioned any new exposure nor shall they be granted renewal/enhancement of any existing exposure.

Business Loan Documents

4 things

You can avail of a Gauranga Capital business loan by submitting only a handful of documents. Below is our business loan documents list:

- Identity proof or KYC documents such as Aadhaar card, Passport

- Business Proof

- ITR for proof of income

- Bank Statement

Please note that this business loan documents list is indicative. The exact documents required for business loan may vary from case to case based on our assessment program. However, the KYC documents and bank statements are common business loan documents required in each case.

Tips to get LAP at Low Interest

3 Tips

Talk to an Advisor Right away!

Not Sure Which Loan To Take?

we help to choose best loan based on your need.

Client's Review

I loved how simple it was to get an online quote for my travel insurance. The entire process was user-friendly, and the pricing was transparent. Paying and buying the insurance online was seamless. Fantastic service!

A loan against property or Home Equity is a secured loan that helps you avail of credit using your existing property as collateral. A LAP loan has zero restrictions, which means you can use it to finance any big-ticket expense. With a loan on property, you can benefit from the value of the property while you continue to occupy it.

When you avail of a loan against property, you submit your property documents with us as collateral. This is also called a mortgage loan against property.

There are steps -

- Determine your Requirement

- Check Loan Eligiblity

- Calculate Monthly installment

- Fill the Document

- Sumbit the Document

- Enjoy the Loan

There are reasons to choose Loan against Property-

- Quick & easy LAP Loan Processing

- Nature of Collateral accepted for loan on Property

- Longer LAP Loan Repayment Tenure

There are property covered under loan against property-

- Loan against Residential Property

- Loan against Commercial Property

- Loan against Industerial Property

- Loan against land/plot

There are Tips to get LAP at low interest-

- Maintain a Favorable credit score

- Improve Your Business Finance