Term Insurance for NRI is defined as term insurance plan designed for NRI, OCI cardholder ,PIO, and their families to cater to the financial needs of NRI and their families. these plan provide financial security and a death benefit to the family if something happens to the policyholder no matter where they live abroad. NRI can buy term Plan from Indian insurance companies ensuring their famillies has important financial protection even if they are in another country.

with tele medical checkup the online buying process of term plan has become hassle free for NRI living anywhere in the world.

Note: The Full Form of OCI is Overseas Citizenship of India and PIO is Person of India Origin.

Can NRI buy Term Insurance in India?

Yes NRI can easily buy the best insurance plan in India.

Geographical boundaries are no longer a barrier for NRI customer willing to buy term insurance plan in India.they can easily buy term plan in india that allow them to schedule a video or telemedical checkup from residential country.

How do term insurance plan For NRI work in India?

To understand what is term insurance for NRI you need to understand that these plan work like any other protection plan in India. In this the policyholder pays a premium amount to the insurance company in return of pure risk cover. In case of an unforseen event of the policyholder death during the policy tenure the sum assured amount is paid to beneficary.

NRI also have the option to choose the Term insurance ROP(Return of Premium) option in which total of all the premium amount is returned at the maturity if the policyholder survive the policy term.

Moreover NRI can also add riders to enhance their policy.

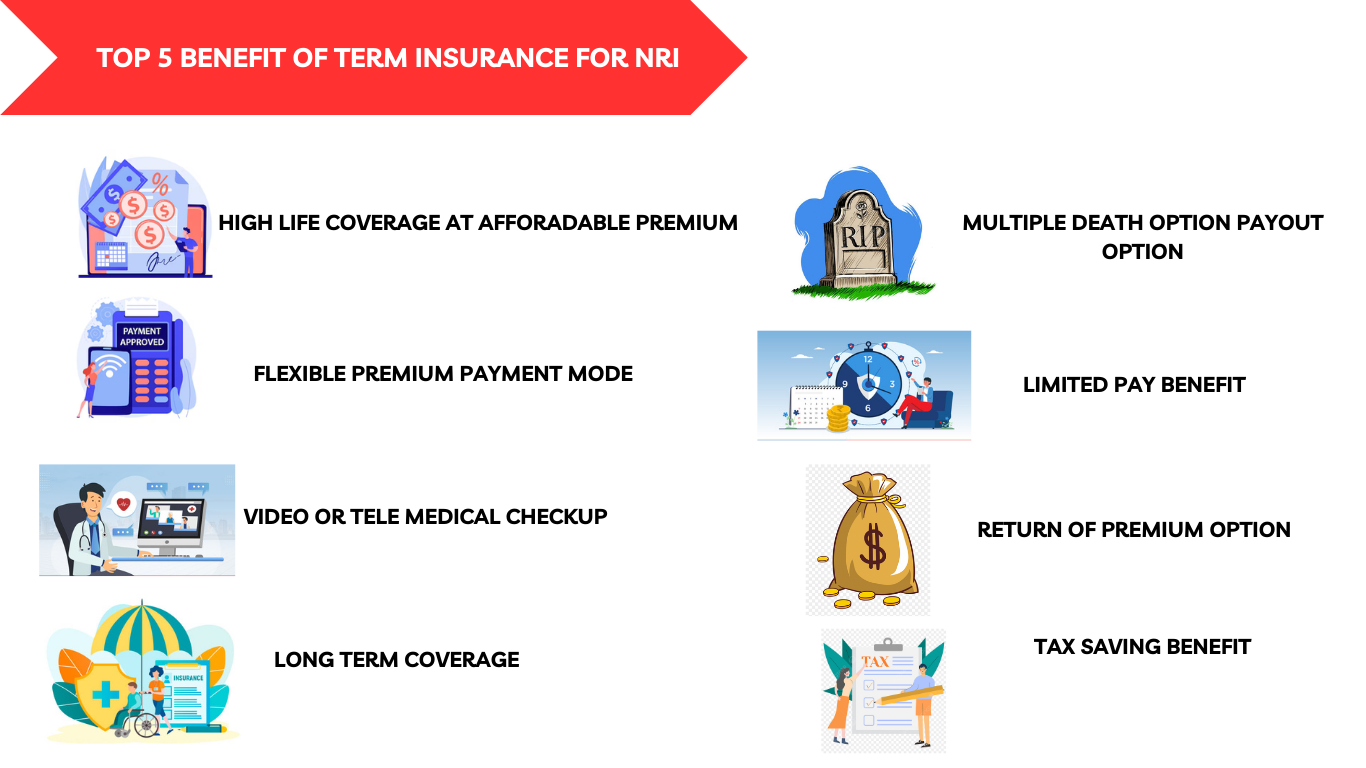

Features For NRI TERM INSURANCE PLAN

- Hassel Free Payment

- Flexible To Choose Life Cover

- Policy Term as Per Your Requirement

- Easy Documentation

- Tax Benefit

Who is eligible to buy Term Insurance for NRI in India?

Here is a list who are eligible to buy term insurance for NRI in India-

Non Residents India- NRI are Indian Citizen with valid passport living temporarily in a foreign country.

Overseas Citizen of India/Person of India Origin: they are citizen of foreign country except for Bangladesh or Pakistan. they should fulfill following criteria

- Having a Indian passport in the past

- Parents or grandparents who were citizen of India

- Spouse of Indian Citizen.

Foreign Nationals- They are citizen of foreign country living in India.

Why should I buy NRI term Life Insurance in India?

Here is a list of reason for NRI to buy term Insurance plan in India:

- Providing financial stability to dependents by compensating income loss in case of unforeseen policyholder death.

- ensure the burden of any outstanding loans/debt at the time of policyholder death does not influence the dependent finances.

- Term Insurance plans in India can be customized to meet Ri specific need and circumstances ensuring comprehensive coverage for themselves and their families.

Why should NRI buy term insurance from India than foreign insurers?

Below there are some of there are some of the reason why term insurance for NRI in India is more beneficial-

The Presence of large number of insurers in India: In India there are various life insurance providers enlisted under the regulating authority and every company offers different type of term insurance for NRI with high life cover at affordable rates.

Pre Approved Cover: You can exclusively get preapproved term insurance cover up to 2 crore with no medical test and hassle free process.

World wide cover with 24/7 Claim assistance: Term Insurance for NRI provides cover all around the world and help customer with claim assistance 24/7.

Medical Cost covered: Several Indian insurers cover the medical cost required to buy NRI term insurance. this means customer would not have to bear the burden of expensive medical test.

Tele medical Checkup: NRI can now easily schedule a video or telemarketing checkup from his/her residential country when buying term insurance for NRI.

Claim settlement Ratio: The CSR is % of claims that an insurance company settles yearly out of total claims. It indicate the reliability and credibility of the insurer. so if the CSR of an range insurer between 95%to 100% you need to think twice before puchasing an NRI term insurance.

Easy Claim Process: Buying an NRI term Insurance from India can help your family get their claims settled easily and hassle free.

Low Premium Rates: Term insurance for NRI Plan from India are approx 50% to 60% more afforadable in rates when compared to international term life insurance plan from other devloped country.